Marketing

The 9 Big Mistakes Public Companies Make With Investor Outreach

The VC Blog is a new channel for fresh perspectives on design and the media landscape, as well as developments at Visual Capitalist. To visit the main site, click here.

Do you know why investors buy shares in household names like Apple or Amazon, even though they are often considered expensive?

The simple reason is that people are comfortable with these names. Not only are they some of the biggest companies globally, but the constant media coverage they receive ends up dominating the financial news, creating continuous and validating exposure.

The result?

These are the types of companies that don’t need any introduction. You know what you are getting when you are buying a blue chip name, and other people know it as well.

The Awareness Problem

Unfortunately, only a handful stocks carry this kind of brand name recognition.

In total, there are more than 10,000 public companies being traded on North American exchanges alone, and the vast majority of them fly well below the radar.

The grim reality for most publicly traded companies is the following:

- Very few investors will know your company and what you do

- Even fewer will understand the potential value the stock provides investors

- You are competing against thousands of other companies for the same attention

To make up for it, companies spend millions of dollars on investor relations, marketing, and PR functions, with often unsatisfactory results.

Where do investor awareness programs go wrong, and can smaller public companies ever make up ground on the iconic companies that dominate the financial media landscape?

The 9 Big Mistakes

Over the past five years, Visual Capitalist has produced and published over 1,500 pieces of content geared towards an investor audience, hitting over 100 million views for our advertisers and sponsors in the process.

In that span of time, we’ve been closely integrated into the investor outreach campaigns of our clients, which range from smallcap to megacap public companies. We’ve seen practically every tactic for investor outreach, and we’ve learned a lot along the way.

Here are the most common mistakes we see in investor awareness programs, with a focus on aspects of content marketing and storytelling.

1. Me, Me, Me…

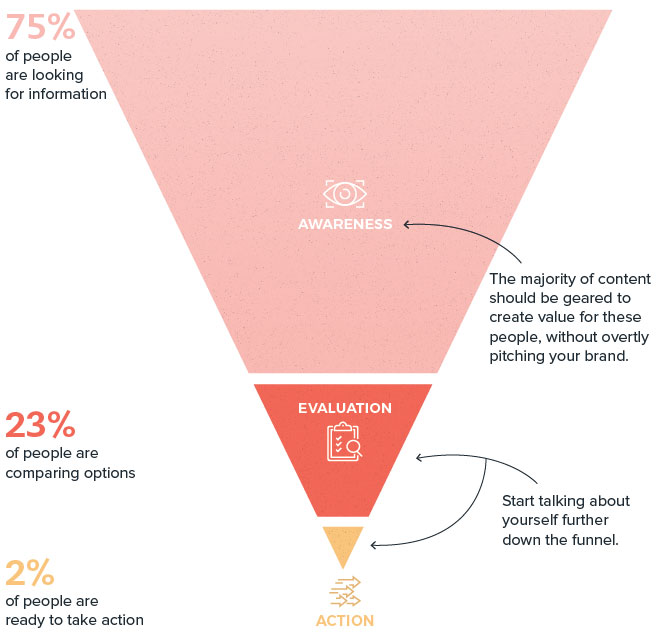

This is a blunder that gets made by almost everyone, simply because there is a natural tendency in business to be self-promotional.

However, if you only talk about yourself, nobody is going to listen.

There is a time and place for a sales pitch on what makes your company a great opportunity, but it should make up a minority of any of your content or outreach materials.

What people really want is for you to deliver them value. Instead of talking about “me, me, me”, figure out what type of content will help your target audience in some way.

If you don’t know how to do this, put yourself in their shoes for a moment.

Would they rather see an ad, or would they prefer to learn something new? Do they want to see a sales pitch, or do think they want to be inspired?

2. Skipping the Context

In the field of psychology, there is a cognitive bias called “The Curse of Knowledge”.

Simply put, this is a common mental shortcut that occurs when a person unknowingly assumes that others have the background to understand what they are explaining.

In other words, for people with technical backgrounds or complex stories, it is easy to mistakenly assume that others already know what you know. After all, you are steeped in the nuances of your niche every day and rarely have the chance to see an outsider’s perspective.

While it’s true that there are sophisticated investors that may get your story at first glance, the reality is that most people will fail to understand the company without proper context. Make sure you maximize any chance you have to educate people on the big picture trends that are driving your industry, or any other valuable information that will put your individual story into perspective.

If you are the first company to own those macro narratives, even better.

3. If You Build It, They Will Come

This might be the costliest mistake that gets made by public companies, and it can get amplified when it’s combined with Mistake #1 (Me, me, me).

Content marketing can be an extremely powerful and cost-effective way to get your message out, but assuming that any piece of content will automatically get eyeballs is a massive gamble that fails 99.9% of the time.

We see companies shell out tens of thousands of dollars for videos, only to put them on a Youtube channel with just a few hundred subscribers. We see pubcos building out websites that will be seen by almost nobody, and we witness entire campaigns that hinge on the blind hope that a piece of content will “go viral”.

Some rules of thumb here:

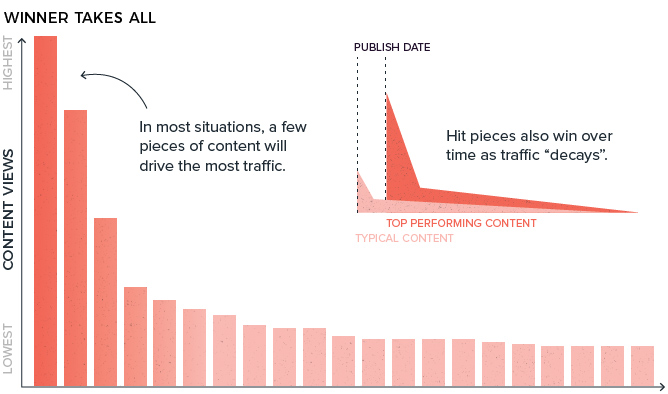

- Every day, you are competing against millions of pieces of content published globally, creating a massive amount of “content clutter”

- The distribution of views for this content follows a power-law dynamic (seen above), in which only a few pieces of content gain the majority of views

- Social media algorithms reinforce this: Facebook, LinkedIn, YouTube, and Twitter only want the “best” content to succeed as it keeps users on their platforms longer

- The odds of investors stumbling across your content via an algorithm are very low, unless you have built up a solid audience and know what makes them tick

- An amazing piece of content that is seen by no one is worthless

One simple suggestion here is to not think about cost in terms of dollars, but in terms of $/view. This isn’t an all-encompassing metric, of course, but it’s a start.

In other words, a $50,000 campaign that is going to reach 50,000 people costs $1 per view, while a $10,000 campaign that reaches 500 people is worth $20/view.

The latter is actually 20x more expensive!

4. The Hail Mary Approach

It’s tempting to think that creating just one breakthrough piece of content can move the needle with your outreach.

However, all evidence suggests otherwise.

Investor awareness is a marathon and not a sprint, and you need constant, consistent, repetition-heavy campaigns that focus on building and reinforcing a narrative. This is even more effective if campaigns are set up as strategic funnels that convert potential leads over time.

In the ad industry, there is a famous rule called the “Seven Times Factor”, which states that you have to see an ad seven times before you buy something.

Such a notion is just as true in investor relations. If you ghost after doing a one-off, nobody will remember a thing.

5. Measuring the Wrong Thing, or Nothing At All

As the legendary Peter Drucker once said, “You can’t manage what you can’t measure.”

Yet, one extremely common mistake we see is a failure to properly quantify the ROI on investor outreach campaigns.

There are a few questions that are worth asking here:

- Can you articulate your outreach objectives in a measurable way?

- What makes a campaign a success or a failure?

- Are you sure you are measuring the right metrics?

- Are you generating sufficient value for the money you are spending?

To complicate matters, we sometimes see media companies or other suppliers muddy the picture even more by providing metrics that are misleading, useless, or flat-out made up.

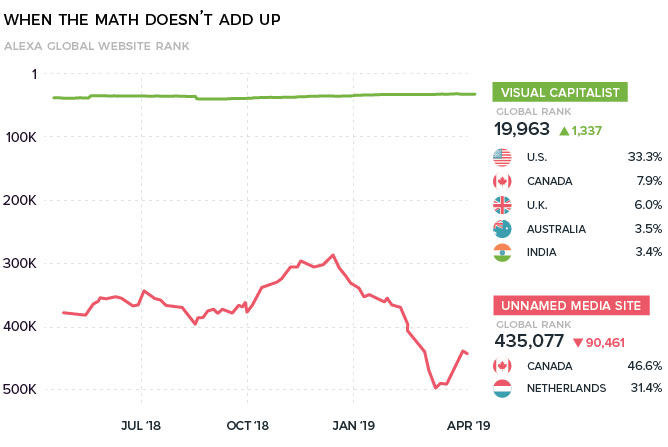

Here’s a traffic comparison between Visual Capitalist and an unnamed “Online Investor Relations Community” that has a founder who claims it gets 400,000,000+ views.

According to traffic estimating website Alexa, you can see Visual Capitalist ranks in the top 20,000 websites in the world for traffic, while the unnamed site ranks 435,077th globally. Do you think a site ranked that poorly really gets 400,000,000 views? Do you think those 400 million views are almost evenly split between Canada and The Netherlands? This doesn’t add up.

Never be afraid to scrutinize information you are given by suppliers.

Also, remember that you can detect BS pretty easily by using traffic estimating websites like Alexa.com (used above) and Similarweb, and by visiting social platforms directly. Make sure to check that demographics line up with who you are trying to reach, and that users are actually interacting and engaging with the content.

6. Expecting an Immediate Response

When you see an ad for a car, do you take action and purchase it right away?

Of course not.

A meaningful purchasing (or investing) decision is something that takes place over time, and is the sum of many different competing factors.

Despite this fact, many public companies expect immediate results from their outreach efforts – they want to see liquidity and a more diverse shareholder base right away.

To get these kinds of results, you need a committed program over time that:

- Hits the right demographic, and hits them often

- Creates a powerful and wider narrative behind your story

- Focuses on delivering value

- Converts people outside of your existing shareholder base

- Has carefully crafted objectives and measurement of ROI

- Leverages multiple channels and mediums

- Generates meaningful and unbiased media coverage

And if you do all of these things, you may even be able to get organic traction – i.e. people spreading your content and narrative at no cost – the ultimate holy grail of quality content marketing.

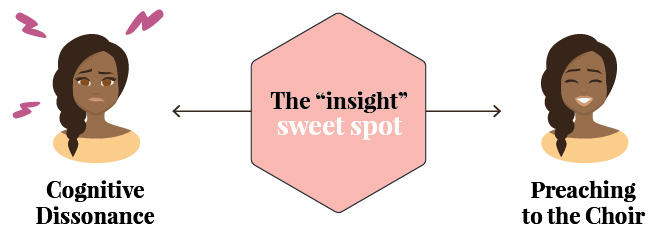

7. Preaching to the Choir

According to a recent survey by BNY Mellon, the number one investor relations goal for companies under US$150 million in market cap is to diversify their shareholder base. Not surprisingly, this is also a top five goal for all other company sizes.

But how can you reach new potential shareholders if you are regurgitating the same message to the same group of people?

“Preaching to the choir” is a classic mistake made in outreach campaigns. It feels comfortable, because it is familiar and you know what the audience wants to hear.

But if you don’t start bringing in new blood (i.e. young people, investors less familiar with the sector, different geographic regions, people that use different platforms, etc.), you will eventually pay a price.

8. Failing to Achieve Any Scale

Leveraging the power of the internet is all about scale.

If you fail to scale your outreach, you are not using your time or money wisely. So how do you become a master of scale?

Here are some ways to think about it:

- Scale is about getting bigger results, but at increasingly smaller marginal costs

- Scale is about working smarter and not harder

- Scale is about getting other people to do the work for you – i.e., imagine people spreading your message for you at no cost, even when you are sleeping

- Scale is about leveraging the maximum amount of value out of the assets you create

- Scale is about making a small adjustment – say an A/B test on your messaging – and seeing an immediate and powerful response

- Scale is about focusing on what you do best, and delegating other activities to those who can execute on them the best

If you feel like you are running on a hamster wheel, and that you are always reaching the same exact people with your efforts – then you probably are missing out on the power of scale.

9. Failing to Make a First Impression

As a final point, it’s worth mentioning that we live in a world where everyone is constantly being bombarded by information.

Making matters worse, people will make up their mind instantaneously on whether something is worth looking at. These decisions are made unconsciously and in the blink of an eye, creating a massive margin for error on how content is presented for a first impression.

If someone interprets your link to be overly technical or convoluted, people’s eyes will glaze over. You need to create an easy in, whether that is a well-crafted “hook” or a visually compelling chart. Otherwise, they will scroll past and go to the next email or social media post in their newsfeed.

Keep it simple. Keep it compelling. Make it engaging. Make it valuable.

These are the ways you earn eyeballs.

Looking to make the most out of your next investor outreach campaign?

We can apply these lessons to help you maximize impact. Get in touch or learn more about advertising opportunities to reach our growing audience.